People

Gerry Cardinale

John Thornton

Robert Klein

Hamid Biglari

Paolo Scaroni

Jeff Shell

Jeff Zucker

Mark Dowley

Dan Swift

Tyler Alexander

David Castelblanco

Andy Gordon

Andrew Lauck

Pravin Manglani

Julia Wittlin

Mike Zabik

David Grochow

Rani Raad

Zlatan Ibrahimović

Alexander Blankfein

Yasser Ezbakhe

Kevin LaForce

Brandon Snow

Colleen Quilty

Marc Younan

Michael Chiaravalloti

Jason Port

Irene Keskinen

Dana Covo

David Dingman

Beau Duncan

Taylor Elliott

David Kebudi

Toby Lee

Katherine Maxwell

Matt Robinson

Dillon West

Alex Balleza

Jake Cohen

Kyle Law

Dean Pacinelli

Michael Tkach

Michael Garcia

Eric Greenstein

Jeff Hirsh

Jason Kao

Oscar Lin

Cameron Luther

Elizabeth Owen

Michael Procaccino

Noah Scholnick

Chase Shea

Nelson Urdaneta

Kimberly Raba

Sarah Elkin

Ashleigh Coughlan

Christopher Surot

Matthew O’Brien

Matthew Shearin

Pechie Wat

Founder and Managing Partner

Gerry Cardinale

Gerry Cardinale is the Founder, Managing Partner and Chief Investment Officer of the firm.

RedBird manages $9 billion of equity on behalf of a select group of blue-chip institutional and family office investors. The Firm’s prior and current investment portfolio includes many of the world’s most iconic entrepreneurs, properties and brands across the sports, media and entertainment industries – including Fenway Sports Group (Boston Red Sox, Liverpool FC, Pittsburgh Penguins, New England Sports Network); the Yankees Entertainment & Sports (“YES”) Network (New York Yankees and Amazon); Skydance Media (Larry and David Ellison); The Springhill Company (LeBron James and Maverick Carter); the XFL (Dwayne Johnson and his partner Dany Garcia); and European football’s A.C. Milan which recently won Italy’s Serie A Championship.

Since the Firm’s inception, RedBird has also been an active investor and company builder in Financial Services — a core competency of the Firm with a dedicated investment team that has invested over $1 billion across Insurance & Insurance Distribution, Asset & Wealth Management and Fintech & Insurtech. Notable investments include Aquarian, a diversified life and annuity insurance carrier with over $7 billion of assets and an affiliated asset manager; and Constellation, a managing general agent insurance distribution platform that RedBird scaled to a top 5 player in the industry in under two years before exiting to Truist in July 2021.

Prior to founding RedBird in 2014, Gerry spent 20 years at Goldman Sachs where he was a Partner of the firm and a senior leader of the Merchant Bank’s private equity investing business. During his tenure, Gerry worked with entrepreneurs and family business owners to build several successful multi-billion-dollar companies, including the Yankees Entertainment & Sports (“YES”) Network, Legends Hospitality, and Suddenlink Communications.

In addition to his broad responsibilities as Chief Investment Officer, Gerry is actively engaged in company-building activities across the Firm’s portfolio in its core industries of Sports, Media & Entertainment and Financial Services. He is also active in driving RedBird’s commitment to diversity, equity and inclusion within the Firm as well as within the investment portfolio. Accordingly, 50% of the Firm’s investment professionals and 30% of CEOs in its most recent fund are either female or diverse.

Philanthropically, Gerry is a Trustee of the Mount Sinai Health System in New York City and leads one of the multi-state Selection Committees that awards Rhodes Scholarships each year. Gerry received an Honors BA from Harvard University where he graduated Magna Cum Laude and an M.Phil in Politics and Political Theory from Oxford University where he was a Rhodes Scholar.

Chairman

John Thornton

John Thornton is the Chairman of the Firm.

John has had a legendary career on Wall Street spanning over four decades and most recently has served as the chairman of several corporate, public policy and educational boards in the US and China.

John was the Co-President of Goldman Sachs and prior to that served as (i) the Co-CEO of Goldman Sachs International, where he is largely credited for building Goldman Sachs’ business outside the United States, and in this capacity also served as (ii) the Chairman of Goldman Sachs Asia.

After retiring from Goldman Sachs, John became the first non-Chinese full professor at Tsinghua University in Beijing since 1949, where today he is also the director of the Global Leadership Program for the university.

He currently sits on multiple boards, and has a long history of corporate and philanthropic leadership. One of his strengths is his ongoing leadership in Asia. John is Co-Chair of the Asia Society, trustee of the Tsinghua University School of Economics and Management, and a member of the International Advisory Council of CIC, the Chinese sovereign wealth fund. John recently met with Xi Jinping as part of the US-China summit and CEO delegation in San Francisco.

John has also served on the Boards of HSBC, Intel, General Atlantic, ICBC, China Unicom, IMG, BSkyB, DirecTV, News Corp and on the advisory board of McKinsey and the Council on Foreign Relations. Institutional Investor Magazine named John one of forty individuals who have had the greatest influence in shaping global financial markets over the past forty years.

President & Partner

Robert Klein

Robert Klein is the President of the Firm.

In his current role, Robert oversees the non-investment operations of the Firm, including Capital Partnerships, Finance and Legal & Compliance. Since joining RedBird in 2017, Robert has helped to drive AUM growth from $1 billion to $10 billion and has diversified RedBird’s LP base to include global blue-chip pension plans, endowments, insurance companies, asset managers and family offices. He has also built internal teams to further support and institutionalize the Firm’s operating infrastructure.

In addition to his Firm responsibilities, Robert is also a Board member and/or actively involved in select investments, including AC Milan, Main Street Advisors and Obra Capital. In this capacity, he advises on product creation, business building and capital advisory.

Prior to joining RedBird, Robert worked for ten years at JPMorgan most recently as Global Head of the Alternative Investments Group — a hedge fund, private equity/credit and real estate platform with over $80 billion in assets under supervision. During his tenure at JPMorgan, Robert was also President of J.P. Morgan Alternative Asset Management, a $13 billion hedge fund solutions provider that served both institutional and retail investors globally. He also served on the Private Bank’s Global Investment Review Committee, the Private Equity Portfolio Advisory Committee, the firm’s Commercial Real Estate Council, the Investment Management Americas Operating Committee, and the Private Bank Investment Team.

Philanthropically, Robert is a member of the Cornell University ILR Advisory Council and has been a board member of Make a Wish Foundation of New York. He is also a Friend of the Bruce Springsteen Archives & Center for American Music.

Robert holds a B.S. in Industrial and Labor Relations from Cornell University and an M.B.A. from NYU-Stern School of Business.

Partner and Chairman of RedBird Asset Management & Financial Services

Hamid Biglari

Hamid Biglari is a Partner of the Firm and Chairman of Asset Management & Financial Services.

In that capacity, he helps to oversee the financial services investment portfolio, the implementation of AI across the Firm, and is also involved with the Firm’s strategic growth initiatives globally.

Prior to joining RedBird, Hamid had a distinguished and diverse 30-year career in financial services. From 2017 to 2022, he was a senior executive at Point72 Asset Management, where he co-led the Firm’s global equities trading organization as well as advanced analytics associated with PM portfolio construction, forensics, and performance assessment.

From 2000 to 2013, he was a senior executive at Citigroup, ending his tenure there as Vice Chairman & Global Head of Emerging Markets. He was a member of Citigroup’s Operating Committee and held various senior management roles, including Chief Strategy Officer of Citigroup, Chief Operating Officer of Citi’s global investment banking and trading business, and Global Head of Investment Banking for Financial Institutions.

Prior to Citigroup, Hamid was a Partner at McKinsey & Company, where he co-led the Firm’s investment banking consulting practice. Before that, he was a theoretical nuclear physicist at Princeton University’s Plasma Physics Laboratory, the nation’s leading center for controlled thermonuclear fusion research.

Hamid sits on the Board of Directors of SparkCognition, a rapidly growing provider of enterprise AI solutions globally. He is a member of the Council on Foreign Relations and a Vice-Chair of Asia Society’s Board of Trustees. He also sits on the President’s Advisory Council and Advisory Board of the Bendheim Center for Finance at Princeton University. While at Citigroup, he was a member of the US-China Business Council. From 2013 to 2015, he was a Board member of Avolon Holdings, the global jet leasing company, and Head of its Compensation Committee, until its sale to HNA Group.

An Iranian-American, Hamid was awarded the Ellis Island Medal of Honor in 2009, given for outstanding contributions to the United States by immigrants.

He holds a Ph.D. degree in Astrophysical Sciences from Princeton University.

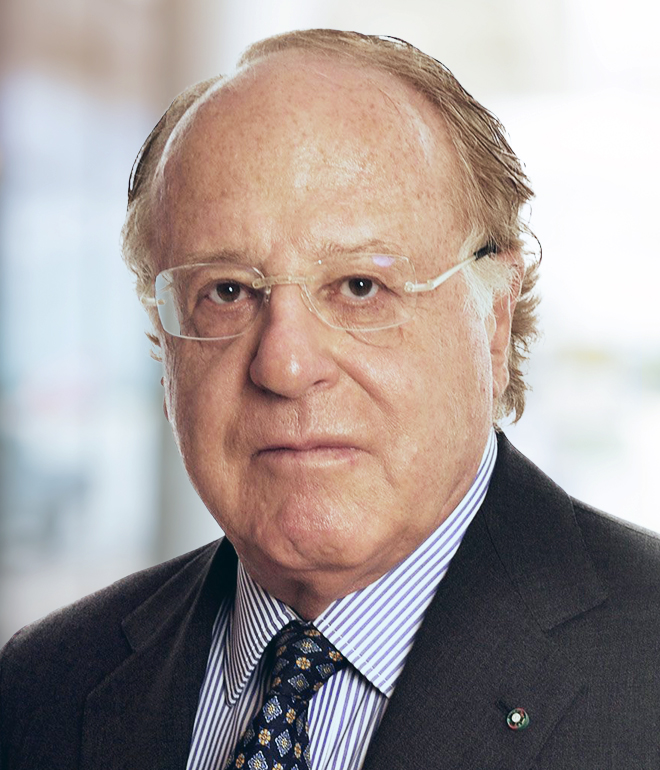

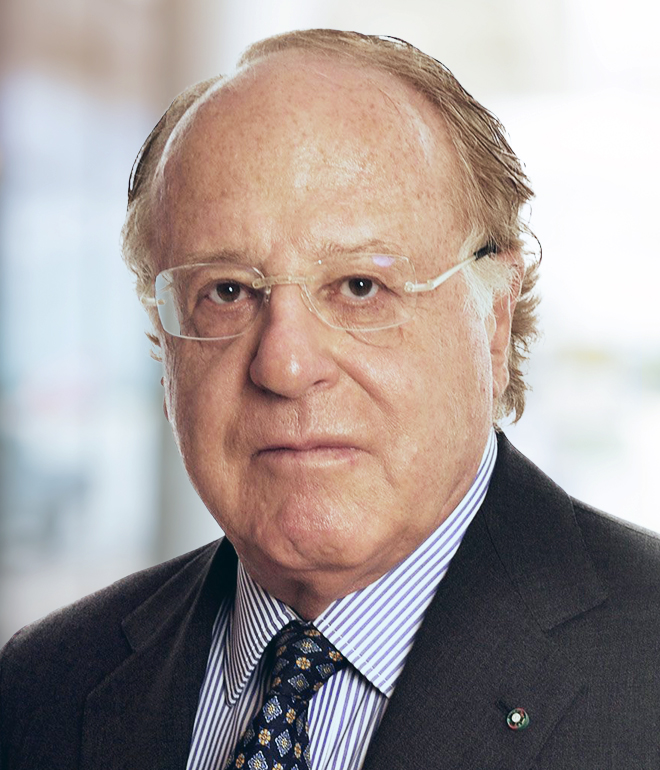

Chairman, International

Paolo Scaroni

Paolo Scaroni is the Chairman of RedBird International.

Paolo is currently the Chairman of the Enel Group, an Italian multinational manufacturer and distributor of electricity and gas.

Over the last year, Paolo has worked closely with RedBird in his capacity as Chairman of AC Milan and has joined us formally as the Chairman of our international business which has been growing on the back of our investments in AC Milan, Liverpool FC under Fenway Sports Group, Toulouse FC, and the Rajasthan Royals Indian cricket team.

Over the course of his 54-year career as an industrialist and banker, Paolo has served as (i) CEO of multiple leading corporations; (ii) Chairman roles at financial institutions and exchanges, including Vice Chairman of the London Stock Exchange; and (iii) on boards for leading universities and institutions in Europe and the U.S.

Chairman, Sports & Media

Jeff Shell

Jeff Shell is the Chairman of RedBird Sports and Media.

Jeff was named Chief Executive Officer of NBCUniversal in January 2020. He oversaw the company’s valuable portfolio of news, sports, and entertainment networks, a premier motion picture company, significant television production operations, a leading television stations group, and world-renowned theme parks.

Previously, Jeff was Chairman of NBCUniversal Film and Entertainment. In this role, he oversaw the content creation, programming and distribution engines behind NBCUniversal’s film and network television businesses including NBC Entertainment, Universal Filmed Entertainment Group (UFEG), Telemundo and NBCUniversal International. He was also responsible for driving the extensions of the company’s intellectual property and consumer product strategy with Universal Brand Development, as well as the expansion of the go-to destination for moviegoers with Fandango.

Jeff previously served as Chairman of UFEG, a position he held since 2013. Over the course of his tenure, Universal celebrated four years of record profit, and the two most profitable years in the studio’s 107-year history with titles from some of its biggest franchises such as Fast & Furious, Jurassic World and Illumination’s Despicable Me. With Jeff’s oversight, Universal Brand Development’s portfolio grew extensively to include Consumer Products, Games and Digital Platforms, and Live Entertainment. Fandango’s portfolio expanded to include a global suite of ticketing properties, including MovieTickets.com, Flixster, Ingresso.com and Fandango Latin America. Additionally, the company acquired DreamWorks Animation in 2016, and under Shell’s leadership, the global family entertainment company and its feature film and television brands became an integral part of UFEG.

Prior to joining UFEG, Jeff served as Chairman of NBCUniversal International. In this role, he managed all aspects of NBCUniversal’s international businesses including International TV Distribution, Global Television Networks and International Television Production. He also oversaw, in partnership with their domestic leaders, CNBC International, International Theatrical Marketing and Distribution, International Home Entertainment and International Theme Parks Operations.

Prior to joining NBCUniversal, Jeff served as President of Comcast Programming Group where he was responsible for managing Comcast’s national and regional television networks including E! Entertainment Network, the Golf Channel, International Channel Networks, and Comcast Sports Group, just to name a few. Under his leadership, Comcast’s networks grew significantly in distribution, viewership and profitability during his six-year tenure.

Before Comcast, Jeff was CEO of Gemstar TV Guide International leading the business through a number of legal and operational challenges. Previous to Gemstar, he held several positions at News Corporation including President, FOX Cable Networks Group. He also held leadership roles at The Walt Disney Company and Salomon Brothers prior to joining News Corporation.

Jeff serves on the board of several non-profit organizations including the National Constitution Center and organizations focused on public school reform.

Jeff received his Master’s Degree in Business Administration from Harvard University and his Bachelor’s Degree in Economics and Applied Mathematics from University of California, Berkeley.

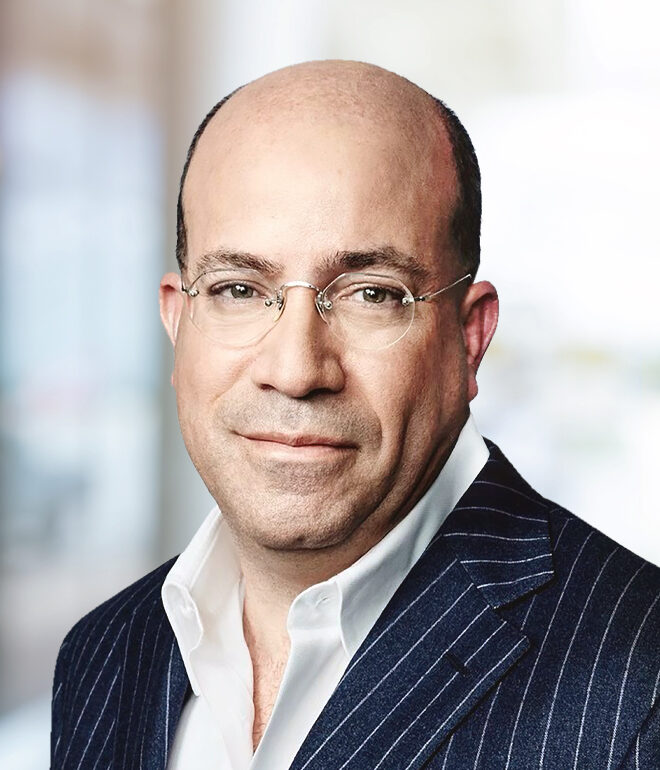

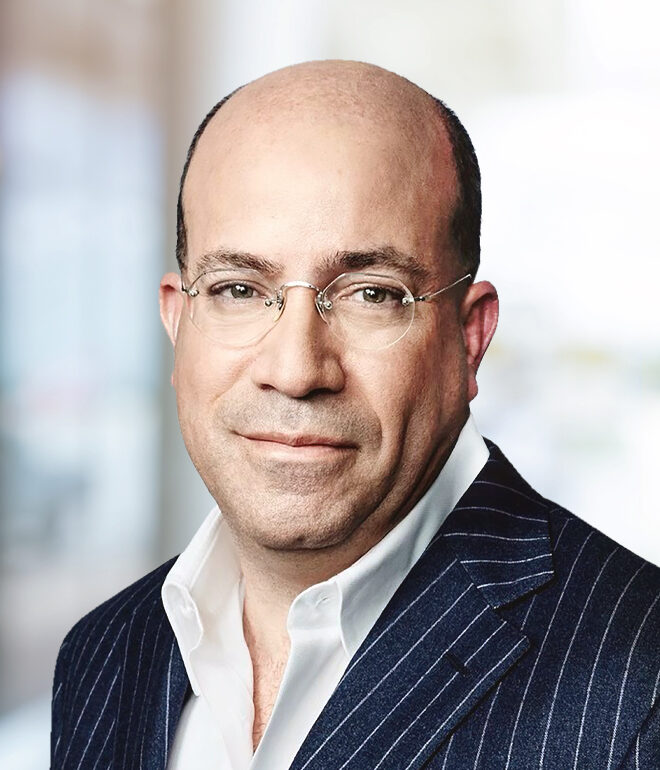

Chief Executive Officer, RedBird IMI, Operating Partner, RedBird Capital Partners

Jeff Zucker

Jeff Zucker is the CEO of the RedBird IMI and an Operating Partner at RedBird Capital Partners. RedBird IMI is a joint investment vehicle focused on acquiring, investing in and building large scale media, entertainment and sports content properties on a global basis.

Jeff has had one of the most storied careers in media, creating new brands and resurrecting old ones. He spent the last three decades in leadership roles across every part of media, including news, sports, entertainment, and digital innovation.

Most recently, Jeff served as President of CNN, from 2013-2022, and Chairman of WarnerMedia Sports from 2019-2022. In Jeff’s nine years at CNN, he oversaw a dramatic turnaround of the global news network, driving it to its largest audiences ever and turning it into the most used digital news and information outlet in the world. At WarnerMedia Sports he was responsible for all programming acquisitions, production, marketing, league relations and sales. The portfolio included partnerships with the NBA, NHL, MLB and the NCAA for the Men’s Basketball Championship.

Prior to CNN and WarnerMedia Sports, Jeff spent 25 years at NBC Universal. His ascent at NBC began in 1986 as a researcher for NBC Sports’ coverage of the 1988 Summer Olympic Games in Seoul. He then took over NBC’s Today show at the age of 26 and re-invented the historic morning news program. After ten years there and four years as the President of NBC Entertainment, he became the President and CEO of NBCUniversal, from 2007-2011.

While CEO of NBCUniversal, he also co-founded the online streaming service Hulu, in 2007.

A 14-time Emmy Award winner and three-time Peabody Award recipient, Jeff received a BA in American History from Harvard College. He served as president of The Harvard Crimson from 1985 to 1986.

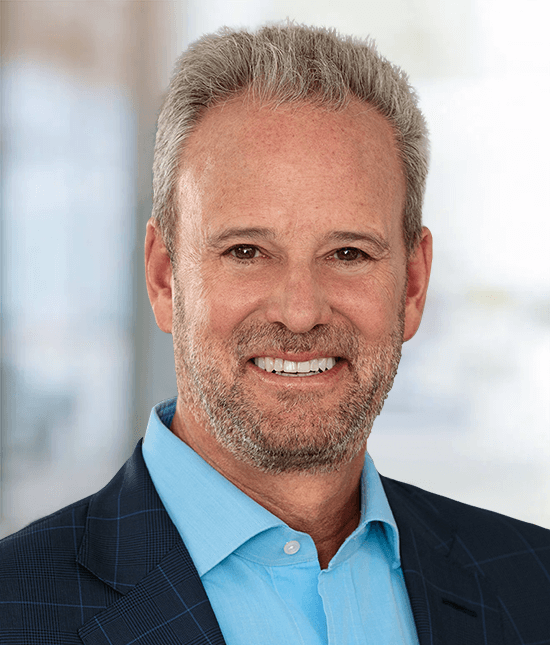

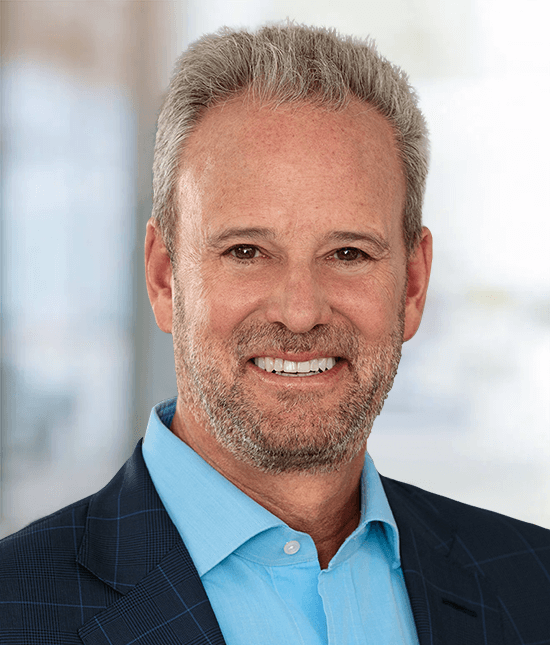

Chief Operating Partner

Mark Dowley

Mark Dowley is the Chief Operating Partner of the Firm.

Prior to joining RedBird, Mark was the Chief Strategy Officer of MacAndrews & Forbes Holdings, a diversified entity with portfolio companies in media, entertainment, consumer products, gaming, biotech, defense and technology.

Prior to MacAndrews & Forbes, Mark was a partner at Endeavor, responsible for overseeing the agency’s corporate marketing, commercial, digital and new business efforts. Prior to Endeavor, Mark was the Chairman and Chief Executive Officer at Interpublic Sports and Entertainment Group, where he oversaw multiple divisions, including Octagon, Octagon Motorsports, Initiative Media, PMK/BNC, Rogers & Cowens and GM EventWorks. Mark was also vice chairman of McCann-Erickson WorldGroup. In his various roles, Mark has created and managed sponsorship and media transactions with professional and amateur sports leagues, global artists, musicians and athletes, including NBA, Premier League, MLB, NFL, Live Nation, The Rolling Stones, Jay Z, the Grateful Dead and LeBron James.

In 2008, Mark founded Art & Science (“A&S”) to provide strategic marketing, communications, creative services and sponsorship portfolio management to a global set of Fortune 500 companies. A&S, via its Artists in Residence program, creates proprietary marketing solutions in partnership with companies to help increase market share, drive revenue and enhance business results. In 2021, RedBird acquired A&S to be a strategic growth partner for RedBird portfolio companies.

Philanthropically, Mark has been actively involved in raising support for COVID relief. He produced two documentaries, including “Sparks in the Darkness“ and the “Surge at Mt. Sinai” as well as the music series “Pay it Forward for Small Business.” Together with Bobby Shriver and Bono, Mark is the co-creator of Product (RED), a global AIDS/HIV relief organization, which has raised more than $700 million from global consumers.

Mark currently sits on the boards of the Child Mind Institute, the world’s leading childhood mental health clinical research organization, and the U.S. Ski and Snowboard Team. He is also on the board of Pharrell Williams and Virgil Abloh’s Black Ambition, which is dedicated to providing business grants to young BIPOC entrepreneurs. Most recently, Mark has been appointed as a director to the Bahamas National Trust Fund Inc. (“BNT”), that pursues advancement opportunities in support of the environment and people of The Bahamas.

Mark holds a B.A. from The College of Wooster where he currently sits on the Board of Trustees.

Partner

Dan Swift

Dan Swift is a Partner of the Firm and focuses on Portfolio Monitoring and Capital Markets activities.

In his current role, Dan oversees RedBird’s Portfolio Monitoring Team, which manages the Firm’s portfolio positions across the lifecycle of each investment. This team, which includes senior professionals across all functions of the Firm, works directly with deal teams and portfolio company management to achieve the investment outcomes that we underwrite. The PMT process encompasses quarterly financial reporting, strategic and operational reviews, and sector-specific analysis, all geared toward ensuring that we execute on our investment thesis, adapt to ever-changing market conditions, and maximize the value of our investments over time. Dan is also actively involved in all Capital Markets activity across the portfolio.

Prior to joining RedBird, Dan had a successful 22-year career at Goldman Sachs, where he was a Partner of the firm and led the Corporate Finance practice and co-led the Technology, Media & Telecom group of Goldman in Asia. He was a founding member of Goldman’s Beijing office, and also lived in Hong Kong and Singapore, spending 17 years in Asia. During his tenure, Dan advised Goldman’s largest clients in Asia and led deal teams across Greater China, Korea, India and Southeast Asia. He was a member of the firm’s Capital Committee and Commitments Committee, supervising all aspects of Corporate Finance and M&A execution. Dan also served on the Listing Committee of the Hong Kong Stock Exchange, guiding key policy reforms for the Hong Kong capital markets.

Philanthropically, Dan is a trustee of the Asian Cultural Council in New York City and the International Advisory Council of Washington University in St. Louis.

Dan holds a Bachelor of Fine Arts degree from Washington University and an M.B.A. from Massachusetts Institute of Technology.

Partner

Tyler Alexander

Tyler Alexander is a Partner of the Firm and focuses on TMT investments.

In his current role, Tyler is actively involved in the Firm’s investment in Talent Systems, which he holds a board seat on, as well as TierPoint and Next Tier Connect. He was also involved with N3, which was exited in 2020 and Compass Datacenters, which was exited in 2023. Collectively, these companies have closed 15+ add-on acquisitions, while also executing over $6 billion of debt and equity financing transactions to support continued growth across the technology landscape. In addition, Tyler works closely on Capital Markets activity for the existing portfolio and leads the Firm’s Management Compensation Team.

Prior to joining RedBird, Tyler was an Associate at MidOcean Partners, a New York-based private equity firm focused on consumer and business services. Prior to MidOcean, Tyler began his career at Rothschild & Co. in the firm’s global advisory restructuring group. At Rothschild, Tyler specialized in special situations, debt advisory, and in-court and out-of-court restructuring transactions related to the financial crisis.

Philanthropically, Tyler is a Member of the New York Regional Board for the College Foundation of the University of Virginia.

Tyler holds a B.A. in History with distinction from the University of Virginia, where he was a Jefferson Scholar.

Partner

David Castelblanco

David Castelblanco is a Partner of the Firm.

In his current role, David focuses on Media, Entertainment and Consumer investments.

Prior to joining Redbird, David spent over 20 years with Goldman Sachs’ Merchant Banking Division where he was a Managing Director in their private equity investment business. He worked closely with Gerry Cardinale for over a decade helping to build the Merchant Bank’s TMT investment business. He invested over $4 billion in the U.S., primarily in the Media, Communications, Entertainment and Consumer sectors. David went on to establish and run the Merchant Bank’s Latin America investment business, opening their first office in São Paulo.

During his tenure, David worked closely with entrepreneurs and management teams to build several successful industry leading platform companies, including the Yankees Entertainment & Sports (“YES”) Network, the #1 Regional Sports Network in the United States. He is currently the Chairman of the Board of Directors of Oncoclinicas, one of the world’s largest private providers of cancer care.

Philanthropically, David is a Member of Stanford Law School’s Board of Visitors and Dean’s Advisory Council. He serves on the President’s Advisory Council on Economics of Brown University and is a member of Newark Academy’s Board of Trustees. David received a BA from Brown University, a JD from Stanford Law School and an MBA from the Stanford Graduate School of Business.

Partner

Andy Gordon

Andy Gordon is a Partner of the Firm and leads the Firm’s Los Angeles office as well as its Technology, Media & Telecom (“TMT”) investment vertical and its Capital Markets activities.

In his current role, Andy is responsible for RedBird’s West Coast business and established the Firm’s Los Angeles office in 2021. In addition, Andy helps lead the Firm’s Capital Markets initiatives, supporting RedBird’s existing investment portfolio as well as strategic opportunities for new investments. Within the portfolio, Andy helped source the Firm’s investments in Skydance Media with the Ellison family, Talent Systems and Hidden Pigeon.

Prior to joining RedBird, Andy had a distinguished 35-year career at Goldman Sachs, where he was most recently the global chairman of Investment Banking Services, head of the Investment Bank’s West Region, global head of media and telecommunications for the Technology, Media and Telecom Group, and co-head of the One Goldman Sachs family office initiative in the Americas. He advised some of the most prominent industry leaders in Media, Entertainment and Telecommunications, including Disney, AT&T, Liberty Global, Live Nation, IAC/Expedia, Activision, and was the first leader to build and unify the West Region, which now spans three offices generating over $3 billion in revenue.

Philanthropically, Andy is the founding Chairman of the Sierra Canyon School, an early kindergarten through grade 12 college preparatory school in Los Angeles. He serves as a Trustee Emeritus for Wesleyan University and is the Co-Chairman Emeritus and Trustee of the Los Angeles County Museum of Art.

Andy holds a B.A. from Wesleyan University and a general course degree from the London School of Economics.

Partner

Andrew Lauck

Andrew Lauck is a Partner of the Firm and helps lead the Dallas office as well as the Firm’s Consumer investment business.

In his current role, Andrew is responsible for the Firm’s investments in Jet Linx, Blade Urban Air Mobility (NASDAQ: BLDE), BETA Technologies, Aero Centers, Equipment Share and RedBird QSR. Andrew oversaw the Firm’s opportunistic investments during the height of COVID-19 pandemic in both Main Event and Jet Linx. Main Event was exited in June 2022 to Dave and Buster’s, following a robust recovery in performance since RedBird’s initial investment in 2020. Andrew is also a member of the Board of Directors for Blade Urban Air Mobility (NASDAQ: BLDE).

Andrew’s investing activities include high growth platforms where technology and advancement are driving key market differentiation, such as Equipment Share’s SaaS based solution for the retail equipment rental business and the evolution of urban mobility and electric aviation in Blade and BETA, respectively. Andrew’s past investment involvement included Avmont, FireBird Energy, Four Corners Petroleum, Aethon Energy, and Lambda Energy. In addition to his active investment responsibilities, Andrew co-leads the Portfolio Monitoring Team, responsible for overseeing the performance of RedBird’s active portfolio companies. Andrew also helps lead the Firm’s junior investment professional recruiting and development.

Prior to joining RedBird, Andrew was a Vice President of BDT & Company LLC, where he focused on Consumer investments for three years. Prior to BDT, Andrew was an Associate at Flexpoint Ford, LLC. He began his career at Goldman Sachs in both the firm’s Investment Banking and Merchant Banking Divisions.

Philanthropically, Andrew is Vice Chairman of the Board of Vogel Alcove and a member of the Boards of the Frontiers of Flight Museum and the Cotton Bowl Athletic Association, all in Dallas. He is the former Chairman and a current member of Indiana University’s Investment Banking Network Advisory Council.

Andrew holds a B.S. in Finance and International Business, with distinction and honors, from Indiana University.

Partner

Pravin Manglani

Pravin Manglani is a Partner of the Firm and leads the Capital Solutions and Credit Opportunities investment areas.

In his role, Pravin oversees the Firm’s investment activities in opportunistic private credit, preferred and structured equity, asset and royalty acquisitions, and other non-control investments for the Firm’s Capital Solutions and Credit Opportunity vehicles.

Prior to joining RedBird, Pravin had a successful 20-year investing career having invested over $4bn of capital across the capital structure and across both private and public formats, predominantly non-control investments including via opportunistic direct lending, preferred / structured equity, minority equity, asset acquisitions, platform capital, and stressed and distressed debt purchases.

Most recently, Pravin was a Managing Director at Anchorage Capital Group, a $25bn+ AUM alternative investment firm, leading their US private capital efforts for their drawdown investment funds. Prior to that, he was a Managing Director and senior investment professional at Macquarie’s Principal Finance business, a $10bn+ AUM investing effort across the capital structure in private situations utilizing the firm’s balance sheet. Early in his career, Pravin was trained at Goldman Sachs Special Situations Group, as an initial member of the team at the formation of Americas SSG in 2003, and also was the 3rd investment professional to join Apollo Management’s credit hedge fund business in 2005, helping to scale Apollo’s initial efforts in credit. Pravin pivoted to private capital investing in 2011, leading early unitranche market development post the financial crisis, having honed and developed his private capital investment expertise over the last decade.

Pravin graduated from the Jerome Fisher Program in Management & Technology from the University of Pennsylvania, with a Bachelor of Science in Economics from the Wharton School and a Bachelor of Applied Science from the School of Engineering and Applied Science, where he graduated Magna Cum Laude.

Partner

Julia Wittlin

Julia Wittlin is a Partner at RedBird Capital and leads the Firm’s Miami office as well as its Venture and Emerging Growth investment vertical.

In her current role, Julia oversees RedBird’s efforts in venture and emerging growth where it backs disruptive technologies and business models in RedBird’s core areas of expertise. Prior to joining RedBird, Julia spent 15 years at BlackRock. Most recently, Julia was a Managing Director and a senior portfolio manager within BlackRock Alternative Investors, where she developed and led the team’s growth equity investment efforts and deployed over $500 million. Julia’s prior investments include leading companies such as Hashicorp, Rivian, Epic Games, Attentive, and Databricks.

Julia has been recognized by the Wall Street Journal as a Woman to Watch in Private Equity and has authored a number of white papers on private equity and the private markets portfolio. Julia is on the steering committee for the southeast chapter of WAVE, the Women’s Association of Venture and Equity.

Julia received her undergraduate degree from the University of Rochester. She also holds an FRM, CAIA, and CFA charter designation.

Partner

Mike Zabik

Mike Zabik is a Partner of the Firm and leads its Financial Services investment business.

In his current role, Mike leads all sourcing, execution, company building and monetization initiatives across the FIG portfolio. Since 2014, the Firm has invested over $700 million in Financial Services investments across six investments and completed 12 add-on acquisitions. Mike is responsible for the Firm’s investments in Aquarian Holdings, Arax Investment Partners, Obra Capital, Main Street Advisors and Grafine Partners, and is actively involved in Skydance Media and Zenith Shipping. Mike also previously led RedBird’s investment in Constellation Affiliated Partners, an MGA platform, sold to Truist in July 2021 and was involved in OneTeam Partners, which was exited in September 2022.

In addition to his active investment responsibilities, Mike leads the Portfolio Financing Team, which has structured the portfolio company financings across 40 platform investments and over 80 add-on acquisitions.

Prior to joining RedBird, Mike was a Vice President at Ares Management LLC for four years, and before that was an Associate at Kelso & Company. Mike began his career at Deutsche Bank in the firm’s Leveraged Finance and Private Debt businesses.

Philanthropically, Mike is a member of Indiana University’s Investment Banking Network Advisory Council.

Mike holds a B.S. in Finance and Accounting from Indiana University.

Chief Financial Officer

David Grochow

David Grochow is the Chief Financial Officer of the Firm.

In his current role, David is responsible for all financial activities for the firm, including accounting and investor reporting operations, risk management and tax planning.

Prior to joining RedBird, David was the Chief Financial Officer at Irving Place Capital for eight years. Prior to Irving Place Capital, David worked for six years as Controller in the Private Equity Group at The Blackstone Group. David also spent time with Geller & Co. and Arthur Andersen as a Senior Accountant.

David holds a B.B.A. degree from the Goizueta Business School at Emory University and is a Certified Public Accountant.

President, RedBird IMI, Operating Partner, RedBird Capital Partners

Rani Raad

Rani Raad is the President of RedBird IMI and an Operating Partner at RedBird Capital Partners. RedBird IMI is a joint investment vehicle focused on acquiring, investing in and building large scale media, entertainment and sports content properties on a global basis.

Throughout Rani’s career, his global attitude and desire for new challenges has led to his working all over the world across many different facets of the media industry.

Most recently, Rani spent 25 years at Warner Bros. Discovery, Inc., where he held several key leadership positions. Most recently Rani served as President of CNN Commercial Worldwide where he was responsible for all commercial operations of the company and delivered record profits. Prior to that, he ran the company’s portfolio of News, Kids and General Entertainment networks in Turkey and the MENA region. Additionally, he played a leading role in building the company’s international digital advertising platform. Rani also served as AT&T Inc.’s advisor in the Middle East during their ownership period and was the architect behind CNN’s operations in the United Arab Emirates.

Rani was recognised by the World Economic Forum as a Young Global Leader for his contributions to the media industry and was also named as one of Syracuse University’s S.I. Newhouse School of Public Communications’ 50 most successful alumni in the school’s 50 year history. He is currently a Board Member of the Dubai International Chamber. Rani graduated with a B.S. in Television, Radio, Film from The S.I. Newhouse School of Public Communications at Syracuse University.

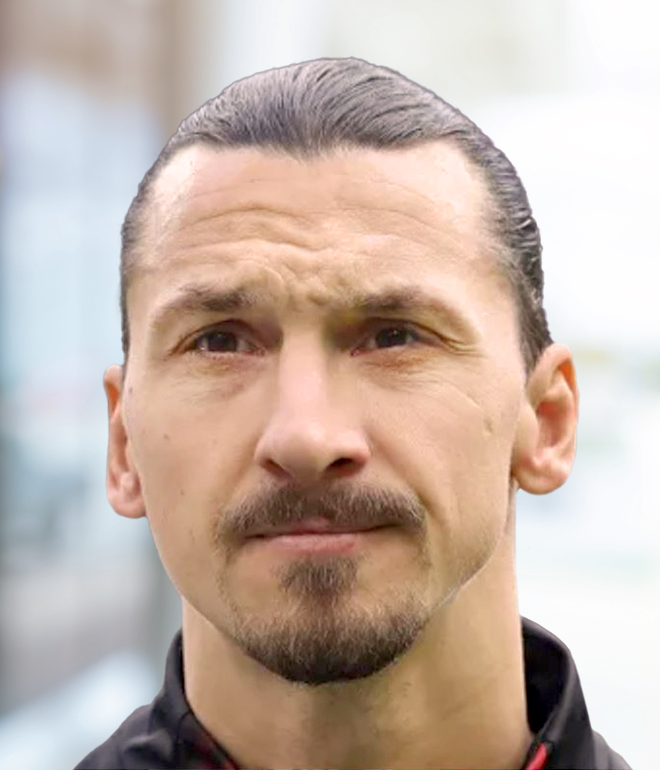

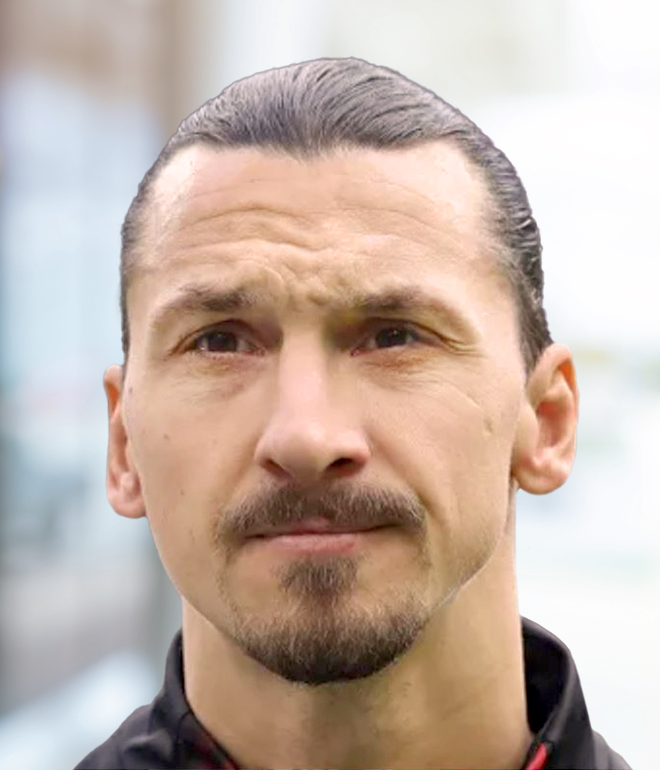

Operating Partner

Zlatan Ibrahimović

Zlatan Ibrahimović is an Operating Partner at RedBird Capital across its Sports and Media & Entertainment investment portfolio. In this capacity, he also serves as a Senior Advisor to AC Milan Ownership and Senior Management.

Zlatan is one of the most iconic football players to have ever played the game. He left his mark on every team he played for, winning 34 trophies between Malmo, Ajax, Juventus, Inter Milan, Barcelona FC, AC Milan, Paris Saint-Germain, Manchester United and the Los Angeles Galaxy.

Over the course of his career, Zlatan scored over 570 goals, including more than 500 club goals, and has scored in each of the last four decades. Zlatan was named the best player in Italy’s Serie A three times (2008, 2009, 2011) and was named the best player in France’s Ligue 1 three times (2012, 2013, 2015). He was also Serie A’s top scorer in 2009 and 2012, Ligue 1’s top scorer in 2012, 2013 and 2015 and the all-time top scorer for the Swedish national team.

Zlatan is a personality whose name resonates far beyond the confines of the football pitch. His prowess on the field has enabled him to build a global brand as an entrepreneur, published author, marketing and advertising specialist and investor. With 123 million social media followers, Zlatan is a global influencer of unquestionable scale and appeal, as well as a best-selling author for his autobiography “I Am Zlatan” which ranks as one of the most successful sports biographies. Zlatan is also a humanitarian who looks to give back, teaming up with the United Nations World Food Program (WFP) to raise awareness of the extent to which hunger persists as a global problem and the 805 million people who are suffering from hunger today.

Managing Director

Alexander Blankfein

Alex Blankfein is a Managing Director of the Firm and focuses on opportunities in the Media, Entertainment, and Experiential Consumer sectors.

In his current role, Alex is responsible for sourcing new investment opportunities and overseeing existing portfolio companies. He co-leads the Firm’s investments in Jet Linx, Aero Centers, Go Rentals, BETA Technologies, and EquipmentShare. He is also involved in the Firm’s investments in Aquarian Holdings, Red6, and Tierpoint. Outside of his investing responsibilities, Alex is a member of the Firm’s portfolio monitoring team, which actively manages the Firm’s investments, and leads the Firm’s junior recruiting and development efforts.

Prior to joining RedBird, Alex was at The Carlyle Group, where he focused on growth, roll-up, and middle-market buyout opportunities across the healthcare, services, and industrials sectors. Successful exits included Newport Healthcare, Thomas Scientific, and PrimeFlight. Prior to Carlyle, Alex was a consultant at Bain & Company, where he was engaged in market, financial, and operational diligence for both private equity and corporate clients and an analyst at Goldman Sachs.

Alex holds both a B.A. in History from Harvard College and an M.B.A. from Harvard Business School.

Managing Director

Yasser Ezbakhe

Yasser is a Managing Director and Head of Data Science & AI at the Firm. In this role, he spearheads the implementation of AI across the Firm by using data science to assist investment teams with due diligence and collaborating with the management of our portfolio companies to drive and deploy advanced analytics and AI.

Before Redbird, Yasser led the Private Equity Data Science practice at Blackstone, overseeing a team of 10 data scientists (in-house and deployed at portfolio companies).

Prior to that, he served as a Data Scientist at McKinsey and at a Tech Startup.

Yasser holds a M.S. in Management Science & Engineering focused in Data Science from Columbia University (NY) and a M.E. in Fluid Mechanics from Ecole Polytechnique (Paris).

Managing Director

Kevin LaForce

Kevin is a Managing Director at the Firm and helps lead its Sports investment business.

In his current role, Kevin oversees the Firm’s investments in EverPass Media, UFL, AC Milan and YES Network and is actively involved in the Firm’s investments in Fenway Sports Group and Skydance Media.

Under Kevin’s leadership, RedBird formed EverPass Media in partnership with the National Football League (“NFL”) in May 2023. Anchored by an exclusive, long-term license to distribute NFL Sunday Ticket into commercial establishments (i.e. bars and restaurants), EverPass provides venues comprehensive access to live sports which are increasingly distributed exclusively via premium streaming services. Kevin also leads all aspects of strategic planning and business implementation for the UFL in partnership with the League’s co-owners the Walt Disney Company, Fox Dwayne Johnson and Dany Garcia. In addition, Kevin is actively involved with the business and commercial development of AC Milan, including advising League Serie A on their global media strategy.

Prior to joining RedBird, Kevin had a highly successful 14-year career at the NFL, where he most recently served as Senior Vice President of Media Strategy and Business Development. Kevin also established and led the NFL’s strategic investment entity, 32 Equity, serving as Vice President from 2013 to 2021.

During his tenure at the NFL, Kevin led the League’s media strategy and business development efforts, focusing on partnerships representing over 70% of the NFL’s annual revenue. Under Kevin’s leadership, the NFL negotiated the most favorable live game distribution contract in the League’s history, valued at over $110 billion. Kevin also grew 32 Equity into a market-leading strategic investment platform. This included the spin-off of the League’s premium hospitality business, On Location Experiences (“OLE”) in partnership with RedBird. This was one of the League’s most innovative and transformative transactions. OLE grew to become one of the world’s leading independent premium event and hospitality platforms increasing its revenue from $20 million at inception to over $550 million upon its sale to Endeavor in 2020.

Prior to the NFL, Kevin was an Associate in Bear Stearns Technology, Media and Telecommunications group, focusing primarily on corporate transactions in the media and content sectors.

Kevin holds a B.A. in English and Government from Lehigh University and a M.B.A. from Duke University’s Fuqua School of Business.

Managing Director

Brandon Snow

Brandon currently serves as Managing Director of RedBird Development Group.

Previously, Brandon served as Managing Director – Commercial & Marketing for Formula 1, the pinnacle motorsports organization delivering some of the world’s greatest sporting events all over the globe. In this capacity, Brandon was responsible for the commercialization of Formula 1’s rights across all primary revenue sources including: Sponsorship, Licensing, Promoter/Markets, Hospitality, Gaming, and other commercial areas. Additionally, he oversaw Marketing for the entity with a core focus of building a diverse and valuable global fanbase.

Prior to Formula 1, Brandon served as the Global Head of Esports for Activision Blizzard, the competitive gaming arm of the world’s largest video game company, where he was responsible for the development, operation, and commercialization of a portfolio of esports products highlighted by the Call of Duty League and the Overwatch League – the first global, city-based esports leagues, and two of the most-watched esports properties in the world.

Brandon also served as chief revenue officer of brand partnerships for Activision Blizzard where he was responsible for the commercial operations of Activision’s and Blizzard Entertainment’s esports programs as well as all brand partnerships with Game IP for the company. This included leading and managing the key revenue lines of the organization across the disciplines of sponsorship, media, and content licensing.

Prior to joining Activision Blizzard Esports, Brandon spent 10 years at the NBA, where his last role was SVP of team marketing and business operations (TMBO). In this role, he helped lead an in-house group consulting arm to drive best practices and innovation across all NBA, WNBA, NBA G League, and NBA 2K esports teams. Brandon also held the role of SVP, global marketing partnership NBA China, where he oversaw partnership sales and activations, licensing, and advertising sales business. Prior to NBA China, Brandon worked at the league office in New York, driving sponsorship and marketing partnership sales efforts globally, including the Latin American, EMEA, and Asia Pacific regions.

Before joining the NBA, Brandon gained an extensive marketing and brand-building experience both in the US and internationally while running global/regional business for leading brands such as McDonald’s and Volkswagen.

Brandon holds a B.A. in Advertising and Marketing from the College of Media and Communications at Texas Tech University.

Head of Capital Partnerships

Colleen Quilty

Colleen Quilty is the Head of Capital Partnerships of the Firm.

In her current role, Colleen is responsible for all existing and prospective Limited Partner relationships. As part of her responsibilities, Colleen oversees fund formation, new and ongoing diligence requests, fund communication and reporting, and manages client relationships. In addition, Colleen is involved in the Firm’s ongoing efforts and commitment to Diversity, Equity and Inclusion.

Prior to RedBird, Colleen was a senior member of the Business Development team at Lone Star, an $85 billion real estate, equity, credit fund. While at Lone Star, Colleen focused on the firm’s marketing and fundraising efforts, as well as managing investor relations. She focused primarily on North American LPs including consultants and public pension plan clients. Prior to Lone Star, Colleen was a Relationship Manager in the Marketing and Investor Relations Group at Och-Ziff Capital Management. Before joining Och-Ziff, Colleen was a Relationship Manager at UBS Wealth Management. Colleen began her career at J.P. Morgan Private Bank as an investor and advisor to families and institutionally sized private accounts.

Philanthropically, Colleen is involved with the Junior League of New York City, an organization of women committed to promoting volunteerism, developing the potential of women, and improving communities through the effective action and leadership of trained volunteers.

Colleen holds a B.A. in Economics from Northwestern University.

Capital Partnerships

Marc Younan

Marc Younan is a member of the Capital Partnerships team.

In his current role, Marc is responsible for all existing and prospective Limited Partner relationships in Europe, Middle East, and Asia.

Prior to joining RedBird, Marc was a senior member of the Business Development/Institutional Sales team at Goldman Sachs Asset Management. As an Executive Director, Marc focused on institutional client’s fund raising across all asset classes and strategic relationships in the Middle East and New Markets. Prior to Goldman, Marc began his career at Bank Audi in Lebanon where he held several positions across retail product development, consumer lending and client service.

Marc holds a B.S in Finance (Honour List) and an MBA (Distinguish List), both from the American University of Science and Technology (AUST) in Beirut.

Counsel and Chief Compliance Officer

Michael Chiaravalloti

Michael Chiaravalloti is the Counsel and Chief Compliance Officer of the Firm.

In his current role, Michael is responsible for all regulatory relationships, compliance and legal activity for the Firm.

Prior to joining RedBird, Michael had a distinguished 15-year career at J.P. Morgan, most recently as a Managing Director and Head of the Global Funds Structuring team within the J.P. Morgan Private Bank’s Alternative Investments Group. The platform had $100 billion in client capital invested across the private equity, hedge funds and real assets at the time of his departure. As part of his activities at J.P. Morgan, Michael served as a director of J.P. Morgan Private Investments Inc., a registered investment advisor, and a member of the Private Equity Advisory Council and Private Investments Council. Prior to joining J.P. Morgan, Michael was an Associate in the Corporate Department at Proskauer Rose LLP.

Michael holds a B.A. in Economics from the University of Notre Dame and a J.D. from Duke University School of Law.

Advisor

Jason Port

Jason Port is an Advisor of the Firm focused on its Venture and Emerging Growth investment vertical.

In his current role, Jason is involved in the Firm’s efforts in venture and emerging growth where RedBird backs disruptive technologies and business models in RedBird’s core areas of expertise. Throughout his career, Jason notably invested in the early stages of high-growth companies including Twitter, Jump Forward and Uber. Jason was one of the earliest employees at Sportsline.com, aiding its rapid growth before its acquisition by CBS. Since then, he has focused his investments in early-stage companies while his consultancy, Network Media Group, has offered strategic consulting to companies of all sizes. As the initial investor in Quirky.com, he was instrumental in backing the vision of the disruptive collaborative innovation platform. Most recently, Jason led business development at LeadEdge Capital Partners, a $5B Venture Growth Fund focused on Saas/Technology.

Jason serves on the Board of Directors of the Heather on Earth Music Therapy Foundation, as well as on the advisory board of the Miami Country Day School. He has also served as a speaker for EY Global’s World Entrepreneur of the Year event in Monaco.

Principal

Irene Keskinen

Irene Keskinen is a Principal of the Firm and focuses on Financial Services investments.

In her current role, Irene is actively involved in the management and oversight of the Financial Services portfolio, including investments in Aquarian Holdings, Arax Investment Partners, Bishop Street Underwriters and Obra Capital. She serves on the Board of Directors of Arax Investment Partners, Bishop Street Underwriters and Obra Capital.

Prior to joining RedBird, Irene spent seven years in private equity at The Carlyle Group and General Atlantic focused on growth equity and buyout investments across the global Financial Services sector. She began her career at Morgan Stanley in investment banking.

Irene holds a M.B.A. from Harvard Business School and joint B.Comm. and B.A. (Economics) degrees from Queen’s University, where she graduated with First Class Honours.

Vice President

Dana Covo

Dana Covo is a Vice President of the firm.

In her current role, Dana works closely with Institutional and EFO partners to tailor investment solutions which help bring strategic capital partners to RedBird portfolio companies, develop co-investment opportunities and connect global family offices.

Prior to joining RedBird, Dana spent four years at the J.P. Morgan Private Bank. In her most recent role, she was an Investment Specialist in the Global Investment Opportunities group (GIO), a team that provides both long term and tactical multi-asset class investment ideas to the firm’s most active and sophisticated Individual and family office clients. Prior to GIO, Dana was part of the Global Investments Business Strategy team. In her role, she helped oversee the management of 700 global Investment advisors.

Dana received a B.A. with honors in English Literature from Emory University where she graduated Summa Cum Laude.

Vice President

David Dingman

David Dingman is a Vice President of the Firm.

In his current role at RedBird, David is actively involved in the sourcing, due diligence and oversight of the Financial Services portfolio.

Prior to joining RedBird, David was the Managing Director of Shipston Group Limited, a private equity firm focused on both international and domestic investments across a wide range of industries, including automotive, biotech, real estate, and fintech. During his 13 years at Shipston Group Limited, David was instrumental in the transformation of several of the Company’s investments into global businesses, many of which were built as platform buy-and-builds. David also directed the reorganization and prioritization of investments with the focus on the monetization of legacy investments through both private and public market transactions. David was a member of Shipston’s Investment Committee, supervising all aspects of the corporate finance and M&A execution.

Among his many investments, David led Shipton’s roll up and integration of multiple high-precision machining companies and low-pressure aluminum casting suppliers to create Mobex Global. Mobex Global is a fully integrated globally trusted partner to the automotive, heavy-duty, construction, agriculture, and industrial markets, and is at the forefront of the evolving mobility industry. In addition, David positioned the IPOs of both China Maple Leaf Educational Systems and Genscript Biotech Corp, solving complicated jurisdictional and governance issues resulting in successful exits. Maple Leaf was the largest private boarding school system in China and Genscript Biotech Corp was a leading Hong Kong gene and cell therapy provider with a current market cap of $37 Billion HK.

Philanthropically, David is an Advisor Advocate for the OKU Foundation and serves on the Board of the Boston Winter Ball. David is also an advisor to the Michael and Elizabeth Dingman Foundation.

David received both his MBA and BA in History from Boston College.

Vice President

Beau Duncan

Beau Duncan is a Vice President of the Firm and focuses on Media, Entertainment and Technology investments.

Prior to joining RedBird, Beau spent five years building the Corporate Development function at Spotify, where he helped lead a number of acquisitions that opened new verticals and drove inorganic growth at the world’s leading music streaming platform. Prior to Spotify, Beau was an Associate at Zelnick Media Capital, a New York-based private equity firm focused on media and entertainment. Beau began his career in Citigroup’s Technology, Media and Telecom investment banking division.

Philanthropically, Beau is actively involved with the JDRF, the world’s largest nonprofit funder of Type 1 Diabetes research.

Beau received a B.B.A. in Finance from the University of Notre Dame.

Vice President

Taylor Elliott

Taylor Elliott is a Vice President of the Firm.

In his current role, Taylor is actively involved with investments across the Consumer portfolio.

Prior to joining RedBird, Taylor focused on growth and buyout investing across the Consumer sector at Prospect Hill Growth Partners, LongRange Capital, and L Catterton. He began his career at Barclays in Investment Banking.

Taylor holds an M.B.A. from the Wharton School of the University of Pennsylvania and a B.S. in Economics from Duke University, where he graduated Magna Cum Laude.

Vice President

David Kebudi

David Kebudi is a Vice President and founding member of the Data Science & AI team at the Firm. In this role, he spearheads the implementation of AI across the Firm to assist investment teams with due diligence and assessment of new technology. He also works with the management of our portfolio companies to drive innovation and deploy advanced analytics and AI.

Before RedBird, David was a member of the Modeling & AI Team at Palantir Technologies, where he oversaw the implementation of cutting-edge AI in military, manufacturing, critical infrastructure, telecommunications, and retail sectors. He was also a member of the team working for PG&E in Northern California that developed software, which decreased wildfires caused by the grid by 99% in 2022 and continues to monitor the grid to this day.

Prior to that, he served as the co-Head of AI at a Tech startup. David holds an M.S. in Mathematics & Computer Science (Data Science) and a B.A. in Economics from Brown University. David holds patents in AI Agent Frameworks, Feedback Loops for ML Models, and Commoditization of Imitation Learning and AI Training.

Vice President

Toby Lee

Toby Lee is a Vice President of the Firm and focuses on TMT and Sports investments.

In his current role, Toby is actively involved in the management and oversight of Talent Systems, EverWonder, UFL and Zenith Shipping. Toby serves on the Board of Directors of EverWonder. He was also involved with RedBird’s prior investments in OneTeam Partners, which was exited in September 2022, and Constellation Affiliated Partners, an MGA platform, sold to Truist in July 2021.

Toby was previously an Investment Banking Analyst at Lazard Freres & Co., where he advised on mergers and acquisitions, activism defense, equity and debt financings and leveraged buyouts in the Technology Group.

Toby received a B.B.A. in Finance and Real Estate from the Goizueta Business School at Emory University.

Vice President

Katherine Maxwell

Katherine Maxwell is a Vice President of the firm. She focuses on portfolio monitoring activities and firmwide strategic projects.

Prior to joining RedBird, Katherine spent 12 years at Goldman Sachs, where she was most recently a vice president and chief of staff to the heads of the investment banking division. Previously, she worked on the Global Markets Institute research team, focusing on public-policy issues and how they affect capital markets. Prior to that, she was chief of staff in Goldman Sachs’ commercial bank and legal department. She began her career as an analyst on the cross-asset sales desk.

Katherine received a BS in Finance, magna cum laude, from Boston College.

Vice President

Matt Robinson

Matt Robinson is a Vice President of the Firm and focuses on Financial Services investments.

Prior to joining RedBird, Matt was a Vice President at Milestone Partners where he focused on growth equity and control buyout investments across the Financial Services sector. At Milestone, Matt was responsible for deal sourcing, transaction execution, portfolio oversight and capital markets activities primarily within the insurance, warranty and specialty finance sub-sectors.

Matt received a B.A. in Economics from the University of Notre Dame.

Vice President

Dillon West

Dillon West is a Vice President of the Firm and focuses on Media, Entertainment and Consumer investments.

In his current role, Dillon is actively involved in the management and oversight of Artists Equity, Talent Systems, Skydance Media and RedBird’s QSR Investment. Dillon serves on the Board of Directors of Artists Equity. He was also involved with RedBird’s prior investment in Main Event, which was exited in July 2022.

Dillon was previously an Investment Banking Analyst at Evercore Partners, where he advised on mergers and acquisitions, equity and debt financings and leveraged buyouts.

Dillon received a B.B.A. in Finance from the McCombs School of Business at The University of Texas at Austin.

Senior Associate

Alex Balleza

Alex Balleza is a Senior Associate of the Firm.

In his current role, Alex is actively involved with the investments across the current Financial Services portfolio.

Prior to joining RedBird, Alex was an Investment Banking Analyst at Wells Fargo Securities, where he advised on mergers and acquisitions, leveraged buyouts and debt and equity financings in the Financial Institutions space.

Alex received a B.S. in Finance from Bentley University.

Senior Associate

Jake Cohen

Jake Cohen is a Senior Associate of the Firm.

In his current role, Jake is actively involved with the investments across the current Consumer portfolio.

Prior to joining RedBird, Jake was an Investment Banking Analyst at Evercore Partners, where he advised on mergers and acquisitions, restructurings, and debt and equity financings in the Transportation and Infrastructure sectors. He began his career at Stifel as an Investment Banking Analyst advising companies on M&A and equity financings in the Healthcare Group.

Jake received a B.A. in Political Science and History from the University of Pennsylvania.

Senior Associate

Kyle Law

Kyle Law is a Senior Associate of the Firm.

In his current role, Kyle is actively involved with the investments across the current TMT portfolio.

Prior to joining RedBird, Kyle was an Associate at Golden Gate Capital, a San Francisco-based private equity firm, where he evaluated leveraged buyout, minority investment, and bankruptcy restructuring opportunities.

Prior to Golden Gate, Kyle was an Analyst in the Investment Banking Division of The Goldman Sachs Group, where he advised a variety of clients within the Technology, Media & Telecommunications Group on mergers and acquisitions, activism defense, equity and debt financings, and leveraged buyouts.

Kyle received a B.S. in Finance from the Stern School of Business at New York University.

Senior Associate

Dean Pacinelli

Dean Pacinelli is a Senior Associate of the Firm.

In his current role, Dean is actively involved with the investments across the current Sports and TMT portfolios.

Prior to joining RedBird, Dean was previously an Analyst at UBS Investment Bank where he worked in the Global Industries Group, focused on Industrial Technology and Tech-Enabled Services.

He received a B.S. in Finance from the Pennsylvania State University.

Senior Associate

Michael Tkach

Michael Tkach is a Senior Associate of the Firm and focuses on the Capital Solutions and Credit Opportunities investment areas.

In his role, Michael is actively involved in investment activities in opportunistic private credit, preferred and structured equity, asset and royalty acquisitions, and other non-control investments for the Firm’s Capital Solutions and Credit Opportunity vehicles.

Prior to joining RedBird, Michael worked as a Vice President at BlackRock in the Opportunistic Credit Group where he invested across the capital structure in both private and public investments. He began his career at Mizuho as an Investment Banking Analyst advising companies on M&A, debt, and equity financings in the Technology, Media, and Telecom Group.

Michael holds a B.S. in Finance from Fordham University.

Associate

Michael Garcia

Michael Garcia is an Associate of the Firm and focuses on TMT and Sports investments.

Prior to joining RedBird, Michael was an Investment Banking Analyst at J.P. Morgan, where he advised on mergers and acquisitions in the Technology sector. He began his career as a direct report to Michael Cembalest, the Chairman of Market and Investment Strategy for J.P. Morgan Asset Management, to assist with the development of J.P. Morgan’s flagship research publication titled Eye on the Market.

Michael received a B.S. in Financial Mathematics and Statistics from the University of California, Santa Barbara.

Associate

Eric Greenstein

Eric Greenstein is an Associate of the Firm.

In his current role, Eric is actively involved with investments across the current TMT and Sports portfolios.

Prior to joining RedBird, Eric was an Investment Banking Analyst at Goldman Sachs, where he advised on mergers and acquisitions, activism defense, equity and debt financings in the Financial Technology and Asset Management space.

Eric received a B.S. in Economics from the Wharton School of Business at the University of Pennsylvania.

Associate

Jeff Hirsh

Jeff Hirsh is an Associate of the Firm and focuses on Sports and TMT investments.

Prior to joining RedBird, Jeff was an Investment Banking Analyst at LionTree, where he advised on mergers and acquisitions, leveraged buyouts, and debt and equity financings in the TMT and Sports space.

Jeff received a B.A. in Economics from Northwestern University.

Associate

Jason Kao

Jason Kao is an Associate of the Firm.

In his current role, Jason is actively involved with the investments across the current Financial Services portfolio.

Prior to joining RedBird, Jason was an Investment Banking Analyst at UBS, where he advised on mergers and acquisitions, leveraged buyouts, and debt and equity financings in the Financial Institutions Group.

Jason received a B.S. in Finance from the Stern School of Business at New York University.

Associate

Oscar Lin

Oscar Lin is an Associate of the Firm.

In his current role, Oscar is actively involved with investments across the current TMT and Consumer portfolios.

Prior to joining RedBird, Oscar was an Investment Banking Analyst at Jefferies Group LLC where he worked in the Global Mergers & Acquisitions Group, focused on the Automotive Aftermarket, Consumer and Sports sectors.

Oscar received a B.S. in Finance from Indiana University.

Associate

Cameron Luther

Cameron Luther is an Associate of the Firm.

In his current role, Cameron works on the capital partnerships team focusing on limited partner relationships and capital raising initiatives.

Prior to joining RedBird, Cameron was an Associate at BlackRock, where he covered the firm’s most strategically important institutional clients focused primarily on U.S. Public and Corporate Pensions.

Cameron received a B.A. in Sociology from Yale University.

Associate

Elizabeth Owen

Elizabeth Owen is an Associate of the Firm.

In her current role, Elizabeth is actively involved with investments across the current Consumer, TMT, Sports, and Energy portfolios.

Prior to joining RedBird, Elizabeth was an Investment Banking Analyst at Barclays Capital, where she advised on mergers and acquisitions, restructurings, and debt and equity financings.

Elizabeth received a B.B.A. in Finance from the McCombs School of Business and a B.A. in Plan II Honors at The University of Texas at Austin.

Associate

Michael Procaccino

Michael Procaccino is an Associate of the Firm.

In his current role, Michael is actively involved with the investments across the current Financial Services portfolio.

Prior to joining RedBird, Michael was an Investment Banking Analyst at Piper Sandler & Co., where he advised on mergers and acquisitions, leveraged buyouts and debt and equity financings in the Financial Institutions space.

Michael received a B.S. in Finance from the University of Richmond.

Associate

Noah Scholnick

Noah Scholnick is an Associate of the Firm.

In his current role, Noah is actively involved with investments across the Venture and Emerging Growth investment vertical.

Prior to joining RedBird, Noah was an Investment Banking Analyst at Moelis & Company, where he advised on mergers and acquisitions, restructurings, and debt and equity financings.

Noah received a B.S. in Computer Science from The University of Michigan.

Associate

Chase Shea

Chase Shea is an Associate of the Firm.

Prior to joining RedBird, Chase was an Investment Banking Analyst at Credit Suisse, where she advised and executed on mergers and acquisitions and leveraged buyouts in the Financial Sponsors Group. In her current role, she works on the Capital Partnerships team focusing on limited partner relationships and capital raising initiatives.

Chase received a B.S.B.A in Finance and Management from Georgetown University’s McDonough School of Business.

Associate

Nelson Urdaneta

Nelson E. Urdaneta Mezerhane is an Associate of the Firm.

In his current role, Nelson is actively involved with the investments across the current Consumer and Sports portfolios.

Prior to joining RedBird, Nelson was previously an Analyst at Morgan Stanley where he worked in the Consumer Retail Group, focused on VMS and Global Beverage.

He received a B.S. in Finance and Accounting from the Stern School of Business at New York University.

Deputy Chief Financial Officer

Kimberly Raba

Kimberly Raba is the Deputy Chief Financial Officer of the firm.

Prior to joining RedBird, Kimberly was a Vice President of Finance at Benefit Street Partners. Prior to BSP, Kimberly worked in a financial reporting capacity at CAN Capital. She also spent time as an auditor at PricewaterhouseCoopers.

Kimberly received a B.B.A. degree from James Madison University, a M.S. degree in Professional Accounting from the Stillman School of Business, and is a Certified Public Accountant.

Kimberly also serves as the New York City Advisory Chair to the SEC Professionals Group.

Human Resources Business Partner

Sarah Elkin

Sarah is a Human Resources Business Partner at the Firm.

Prior to joining RedBird, Sarah was the Chief Administrative Officer and Director of Human Resources at Pura Vida Investments, where she was responsible for creating and implementing human capital strategy. Prior to Pura Vida Investments, she worked with a healthcare equity research team at Diamondback Capital, a multi-manager investment advisor, and at Sivik Global Healthcare, a healthcare-dedicated hedge fund.

Philanthropically, Sarah is an Associate Board Member of The Bowery Mission, a nonprofit organization that serves NYC through Compassionate Care, Residential and Community Programs, Transitional Housing and Children’s Programs.

Sarah holds an M.S. from New York University in Human Resource Management and Development, with a concentration in Organizational Effectiveness, and is a SHRM-CP.

Assistant Controller

Ashleigh Coughlan

Ashleigh Coughlan is an Assistant Controller at the Firm.

Prior to joining RedBird, Ashleigh was a Managing Director at Greystone & Co where she oversaw the Accounting and Finance Department. She held various Finance roles across the firm throughout her 13-year tenure.

Ashleigh received both a B.A. in Business and Accounting from Atlantic Technological University and a M.S. in Finance from the Technological University of Dublin.

Assistant Controller

Christopher Surot

Christopher Surot is an Assistant Controller at the firm.

Prior to joining RedBird, Christopher was a Controller at Kelso & Company. Prior to Kelso, Christopher worked for The Blackstone Group and served as an Assistant Vice President focusing on private equity funds in the Global Fund Finance group. Prior to Blackstone, Christopher began his career in the assurance practice at EY.

Christopher holds an M.B.A. from the NYU Stern School of Business and a B.B.A. from Loyola University Maryland, where he graduated Magna Cum Laude and served on the Board of Trustees. He is a Certified Public Accountant.

Finance Manager

Matthew O’Brien

Matthew O’Brien is a Finance Manager of the Firm.

Prior to joining RedBird, Matt was an Associate in the fund accounting group at Cowen Inc. Prior to Cowen, Matt worked as an Accounting Analyst at Millennium Management. He also spent time as a Senior Audit Associate at KPMG LLP.

Matt received a B.S. in Business Administration and double majored in Finance and Accounting at Saint Joseph’s University.

Finance Associate

Matthew Shearin

Matthew Shearin is a Finance Associate of the Firm.

Prior to joining RedBird, Matt was an Associate in the fund accounting group at Centerbridge Partners. Prior to Centerbridge, Matthew worked as a Senior Audit Associate at Ernst & Young, LLP.

Matthew received both a B.S. in Accounting and an M.B.A. in Financial Management from the Hagan School of Business at Iona University.

Finance Associate

Pechie Wat

Pechie Wat is a Finance Associate of the Firm.

Prior to joining RedBird, Pechie held various positions at Investment Management Corporation of Ontario (IMCO) and the Canada Pension Plan Investment Board (CPPIB).

Pechie received a B.A. in Political Science from the University of Toronto.